Inflationary Impact of the Last Twelve Months

Inflation. It grew to 7.48% for the twelve months ending in January, reaching a 40-year high. The last time we were talking this much about inflation was in the early 1980’s. Well, I wasn’t talking about it, I was picking out my ice cream flavor at Baskin Robbins instead.

It’s 2022 now and ice cream is again on the inflationary menu. As the cost of goods soars, producers are faced with the decision between reduced margins or increasing consumer prices.

And it’s not just ice cream shops facing the freeze. The last twelve months has seen inflation soar to near-record levels creating extra pressure, difficult decisions and a drop in small business confidence.

The Producer Price Index (PPI) was estimated to rise by .5% in January but wholesale prices soared up by 1%, bringing the past twelve months to a total 9.7%. Small business performance is typically a lagging economic indicator and the trending PPI foreshadows where pressure will be in the coming months – higher consumer prices. Stock up on your favorite ice cream now!

According to an NFIB survey, 22% of small business owners report that inflation is their single most important business problem – the highest since 1981. 55% of owners expect inflation to continue to be a problem six months from now.

And the Small Business Optimism Index? That decreased to an 11-month low in January, down 1.8 points from December. The index measures the responses from more than 600 NFIB members on the topics of intent to hire, making capital outlays, increasing inventories, and their expectations of economic improvement, higher sales, current inventory, current job openings, expected credit conditions, expansion timing, and earnings trend.

A Recipe for Pain - Costs, Hiring & COVID

Rising Costs

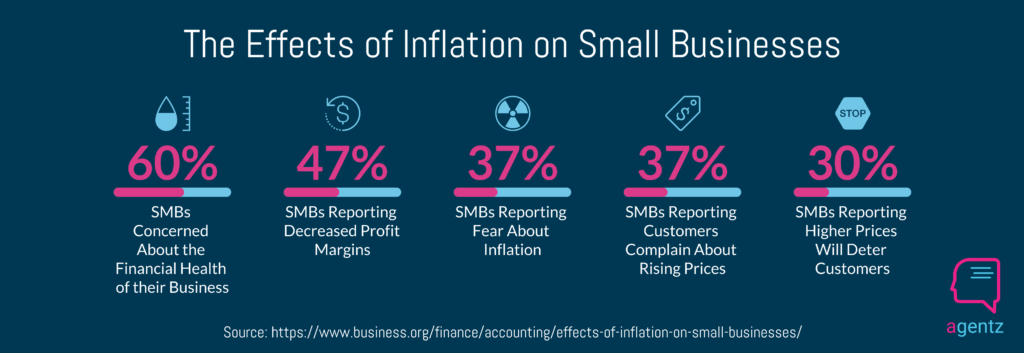

Overall, 74% of small businesses are experiencing increased overhead costs* for things like materials and inventories, salaries, rents, debt and regulations.

Many SMBs have lost leverage with their suppliers who favor terms they can make with larger buyers. SMBs are saddled with higher interest rates on debt, facing rent increases, and are paying up to 30% more for labor than two years ago.

In fact, 60% of small businesses are already paying higher wages with another 27% planning to increase compensation in the coming months.

The impact to consumers is already being felt. 47% of small businesses are passing on rising costs and another 32% are projected to shortly, if inflation persists. This means fewer consumer trips to the ice cream parlor, resulting in loss of revenue and goodwill for the dip shop.

Labor Shortages

Small businesses are painfully understaffed. 12% of small business owners indicate that the labor shortage is the biggest risk to their business and 23% struggle most with labor quality. According to the Q1 CNBC/Survey Monkey Small Business Index, three out of ten owners reported roles unfilled for at least 3 months and 93% report few or no qualified applicants for their positions.

Understaffing impacts multiple areas of the small business including the ability to fulfill the day-to-day production and servicing of customers as well as front office aspects of responding to inbound inquiries for sales and service. When businesses are understaffed, customers are missed and revenue and reputation suffer.

COVID

What drove increased opportunity and revenue for some small businesses during COVID is now going in reverse as the walk-in economy opens back up. Case in point, San Francisco based granola retailer, Nana Joes Granola, experienced rising revenue during COVID as online shopping increased, but the business is now dealing with supply chain challenges and higher costs for their base product, squeezing profit margins.

It is also causing staffing shortages. Two-thirds of small business owners say they have experienced too many workers being unavailable after testing positive for COVID, especially since Omicron entered the scene. This has forced some businesses to shut their doors for days at a time or decrease their service levels and productivity.

According to Alignable’s January 2022 Road to Recovery report, 58% of SMBs state that Omicron is hurting their recovery – a 16 point jump in just one month. Hardest hit are entertainment venues, restaurants, event planners, gyms and the travel industry.

Successfully Managing to Inflation

Short of actually laying off staff or turtling down, there are effective ways for small businesses to reduce overhead costs while still increasing efficiency and productivity to better serve their customers.

Review profit margin. Focus on finding solutions that increase margins while improving quality and value of service.

Reduce inventory. Stock or sell fewer items, make smaller purchases at a time based on your sales clip and credit lines. If you sell high ticket items, consider floor planning.

Assess your workspace. Brick and mortar stores may not have as many options but businesses that can work from home or easily move to a less expensive space, should consider doing so.

Evaluate marketing costs. Review your marketing channels and eliminate or restructure those that are not effective. Make the most of your marketing spend by addressing all inbound inquiries as quickly as possible.

Review headcount expenses. Instead of making that next hire, is it possible to make your current staff more productive and use technology to handle the rest?

Examine your processes. What can you do differently or be more efficient at that helps you save time and provide a better customer experience?

Use Automation. Customer engagement automation tools can handle many basic tasks for you, allowing customers to self-service their needs while easing staff workloads.

Small Business Automation Works

For the thirty percent of business owners struggling to cut costs and fill open roles as a result of inflation, automation can ease those challenges.

Customer engagement automation, frequently overlooked by small businesses despite taking hold in larger enterprises, is a way for owners to communicate with customers 24/7 without the need for constant human intervention.

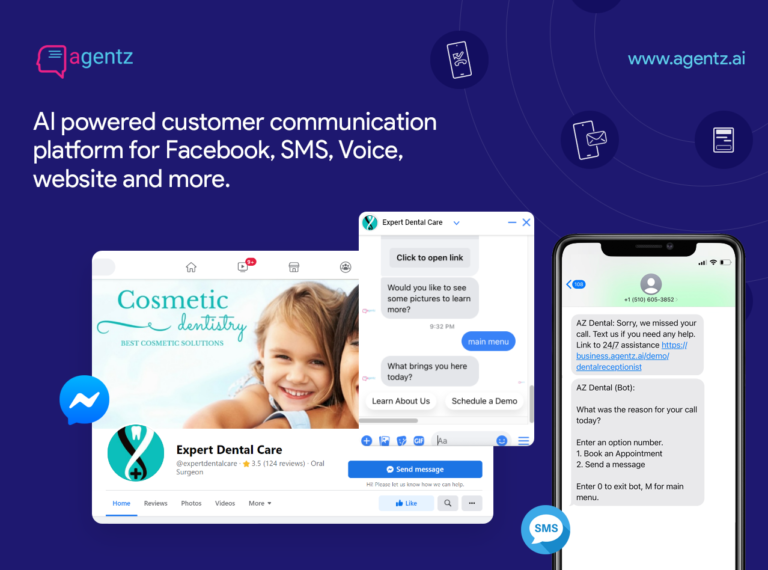

How does automation work? Agentz uses AI-driven automated conversations to communicate with customers across multiple touch points including SMS, the business website, Facebook Messenger, Google Messages as well as responds to missed calls.

Consumers can schedule appointments, ask questions and receive an answer, send a message or learn more about the business. Automation helps consumers get what they need, fast while also alleviating required staff time.

All interactions are captured in the Agentz unified inbox, simplifying customer communications and making it easier for the business to follow-up.

How Small Business Benefits from Automation

Reduce costs. For short-staffed businesses, automation does an effective job supporting customers at a fraction of the cost. At less than 4% of the annual cost of the average US employee, tools like the Agentz Automated Assistant act as the perfect backup to an overwhelmed team.

Agentz works 24/7. Agentz never calls in sick, never gets weary, frustrated or has a bad day.

Improve productivity. Automation allows your teams to focus on the customers and tasks in front of them without the distraction of constantly interacting with inbound inquiries.

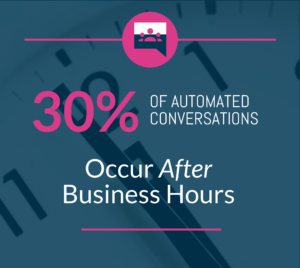

Capture more leads. The average Agentz business user benefits from 25% of their customer interactions being handled by the automated assistant with 30% of them occurring during the off hours. These are customers that likely would have been lost without automation.

Improve customer service. Consumer expectations are changing with many preferring the convenience of automation versus waiting for an email response or sitting on hold for minutes at a time. Automation allows the SMB to respond to inquiries immediately, capturing more customers.

Grow revenue. Automation helps you grow your business by engaging with more customers and enabling them to self-service their own conversion from lead to customer.

About Agentz

Agentz offers the most feature-rich and budget friendly customer engagement automation solution for small businesses.

Contact us to learn how Agentz can help your small business or, if you support SMBs, ask us how your agency, technology or SaaS company can better service your clients.